You can download the Sukanya Samriddhi Yojana Application Form PDF for free by using the direct link provided below on the page.

Sukanya Samriddhi Yojana Application Form PDF

The Sukanya Samriddhi Yojana (SSY) is a significant government initiative designed to foster financial stability and prosperity for young girls in India. This savings scheme offers a secure and structured approach to accumulating funds for the future well-being of girl children. The core objective of the SSY is to facilitate long-term financial planning and ensure a secure financial future for girls, empowering them to achieve their aspirations and goals.

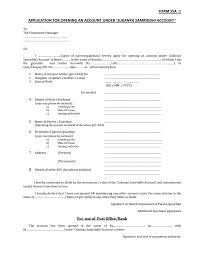

When considering the application process for the Sukanya Samriddhi Yojana, it is crucial to understand the various forms associated with the scheme. The application form serves as the initial step in enrolling in the SSY and setting up a savings account for a girl child. The form includes essential details required for account opening, such as personal information of the account holder and guardian, along with relevant identification documents.

The SSY application form PDF not only facilitates the account opening process but also incorporates additional forms for various account-related transactions. These supplementary forms cater to specific requirements such as premature closure of an account, withdrawal requests, and closure of the SSY account. Each form serves a distinct purpose in managing the SSY account efficiently and addressing different financial needs and circumstances that may arise during the account tenure.

The maturity period of the Sukanya Samriddhi Yojana extends to 21 years from the date of opening or upon the marriage of the girl child after reaching 18 years of age, whichever event occurs earlier. This extended tenure allows for long-term savings growth and financial stability, ensuring that the accumulated funds can support the girl child’s future endeavors, education, and other essential financial goals.

By availing the opportunity to download the Sukanya Samriddhi Yojana Application Form in PDF format, individuals can conveniently access and complete the necessary documentation to initiate the account opening process. The provided link at the end of this article serves as a direct gateway to acquiring the application form, enabling interested parties to kickstart their journey towards securing the financial future of girl children through the SSY scheme.

The Sukanya Samriddhi Yojana stands as a beacon of financial empowerment for young girls, offering a structured savings platform to nurture their dreams and aspirations. Through diligent application and utilization of the associated forms, individuals can leverage the benefits of the SSY scheme to build a solid financial foundation for the future generation, ensuring a pathway to economic independence and prosperity for girl children across the nation.

Eligibility for Sukanya Samriddhi Yojana Application Form

- The Sukanya Samriddhi Yojana offers a unique opportunity for natural or legal guardians to secure the financial future of girl children under the age of 10. Guardians can open and manage a single account for each girl child, with a limit of two accounts per guardian as per scheme regulations. This provision ensures focused savings and streamlined management of funds for the designated beneficiaries.

- One of the key features of the SSY scheme is the competitive interest rate of 7.6%, which is tax-exempt under section 80C, making it an attractive investment option for guardians seeking financial growth with tax benefits. The scheme allows a minimum investment of Rs. 1,000 per financial year, providing flexibility for individuals to contribute according to their financial capacity. the maximum annual investment ceiling stands at Rs. 1,50,000, offering a cap on contributions to optimize savings within the scheme.

- In adherence to the scheme guidelines, depositors are required to maintain a minimum deposit of Rs. 1,000 per financial year to avoid penalties. Failure to meet this requirement may result in a penalty of Rs. 50, emphasizing the importance of consistent contributions to the account. Deposits can be made up to 14 years from the account opening date, ensuring an extended period for savings accumulation and growth within the SSY framework.

- The Sukanya Samriddhi Yojana account matures after 21 years from the opening date, or upon the marriage of the account holder before the completion of the 21-year tenure. In the event of marriage, the account ceases operation post-marriage, aligning with the scheme’s objective of supporting the financial needs of the girl child for education, marriage, and other significant life events.

- To enhance transparency and facilitate account management, customers receive a passbook detailing their transactions and savings progress. This passbook serves as a tangible record of deposits, withdrawals, and account activity, providing a comprehensive overview of the account status and fostering financial awareness among guardians and account holders.

- The Sukanya Samriddhi Yojana offers a structured and tax-efficient savings avenue for guardians to invest in the future of girl children, ensuring financial security and growth through disciplined savings practices and attractive interest rates. By adhering to the scheme’s guidelines and leveraging its features, guardians can pave the way for a prosperous and secure financial future for the young beneficiaries under the SSY scheme.