You can download the PAN Correction Form NSDL PDF for free by using the direct link provided below on the page.

PAN Correction Form NSDL PDF

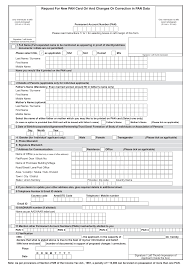

The PAN Card Correction Form serves as a crucial document for individuals seeking to rectify errors or update information in their Permanent Account Number (PAN) data. This form, designed according to the specifications set by the Income Tax Department, plays a pivotal role in ensuring the accuracy and integrity of an individual’s financial records and tax-related information.

Obtaining the PAN Card Correction Form is a straightforward process that can be initiated by visiting designated IT PAN Service Centers managed by UTIITSL or TIN-Facilitation Centers/PAN Centers operated by NSDL e-Gov. Alternatively, individuals can procure the form from authorized stationery vendors or download it directly from the official websites of the Income Tax Department, UTIITSL, or NSDL e-Gov, ensuring accessibility and convenience for applicants across various channels.

Once the PAN Card Correction Form is acquired, it is essential to meticulously complete all required fields with accurate and updated information. Attention to detail is crucial to avoid any discrepancies or delays in the processing of the correction request. Additionally, attaching the necessary supporting documents, such as proof of identity, address, or any other relevant paperwork, is imperative to substantiate the requested changes and facilitate a smooth verification process.

After the form is duly filled out and accompanied by the requisite documentation, applicants can submit the package to the nearest IT PAN Service Centers or TIN-Facilitation Centers/PAN Centers. Upon submission, individuals will receive an acknowledged receipt confirming the receipt of their correction request, providing assurance that the process is underway. Alternatively, applicants have the option to dispatch the form and documents via speed post or regular mail to the specified address of the Income Tax PAN Services Unit at NSDL e-Governance Infrastructure Limited in Pune.

The submission of the PAN Card Correction Form marks the initial step towards ensuring the accuracy and completeness of an individual’s PAN data, reflecting a commitment to maintaining updated financial records and complying with regulatory requirements. By following the prescribed procedures and guidelines outlined by the Income Tax Department, applicants can navigate the correction process seamlessly, leading to the timely resolution of any discrepancies and the issuance of an updated PAN card reflecting the corrected information.

Documents Required for PAN Card Correction Form NSDL

- The PAN Card Correction Form is a critical document for individuals seeking to rectify errors or update information in their Permanent Account Number (PAN) data. When submitting the form, it’s essential to provide documentary proof to support the requested changes. For instance, if there is a change in the applicant’s or father’s name, supporting documents such as a marriage certificate, marriage invitation card, publication of name change in the gazette, or a passport showing the husband’s name (for married ladies) are required.

- Similarly, for individuals other than married ladies, a publication of the name change in the gazette is necessary. Companies must provide the ROC’s certificate for a name change, while partnership firms should submit a revised Partnership Deed. Other registered organizations like AOP/Trust/BOI/AJP need to provide the revised registration/deed/agreement, and Limited Liability Partnerships require the Registrar of LLPs certificate for a name change.

- For foreign citizens, specific documents are needed, including a passport, Person of Indian Origin (PIO) Card, Overseas Citizen Card, bank statement, NRE Bank account details, citizenship identification number (if applicable), and taxpayer identification number attested by Apostille, the Indian Embassy, High Commission, Consulate, or authorized officials of scheduled banks registered in India with branches overseas. These documents are crucial for verifying the identity and facilitating the correction process effectively.

- By ensuring the accurate submission of the PAN Card Correction Form along with the necessary supporting documentation, applicants can expedite the correction or change process for their PAN data.

- Each document plays a vital role in validating the requested modifications, reflecting the commitment to maintaining accurate financial records and complying with regulatory standards. The meticulous preparation and submission of these documents showcase the applicant’s dedication to rectifying any discrepancies and ensuring the integrity of their PAN information, paving the way for a seamless correction process and the issuance of an updated PAN card with the corrected details.

PAN Card Address Change/Update Procedure

- To update your address in your PAN card using your Aadhaar number, you can follow a simple process through the Address Update link provided. By accessing this link, you will have the option to update your address information using Aadhaar-based e-KYC verification. This feature is particularly beneficial for individuals who wish to align their address details in the PAN database with those in their Aadhaar card.

- To make use of the Address Update facility, it is imperative to have your Aadhaar card handy, as well as a registered mobile number or email ID linked to your Aadhaar account. Upon initiating the process, a one-time password (OTP) will be sent to the mobile number or email ID associated with your Aadhaar for the purpose of generating an Aadhaar-based e-KYC verification.

- Once the Aadhaar-based e-KYC process is successfully completed, the address details as per your Aadhaar card will be seamlessly updated in the PAN Database, ensuring consistency and accuracy in your records. Subsequently, you will receive a notification via email confirming the successful update of your address, sent to both the mobile number and email ID specified during the utilization of this service.

- As part of this process, your updated mobile number and email ID will also be reflected in the PAN database maintained by the Income Tax Department, streamlining communication and ensuring that your contact details are up to date for future correspondence. This comprehensive approach ensures that your address information is accurately synchronized across official platforms, facilitating efficient communication and compliance with regulatory requirements.

How to Apply for PAN Card with Name Change

- To initiate the process of updating or correcting details on your PAN card, the first step is to visit the official website of UTI, which is one of the authorized platforms for PAN-related services. Once on the website, navigate to the left-hand side of the screen and locate the option labeled ‘For change/correction in PAN card click here.’ This clickable link serves as the gateway to accessing the necessary forms and procedures for making alterations to your PAN card information.

- Upon clicking on the designated link, you will be directed to a specific section titled ‘Apply for Change/Correction in PAN Card details (CSF).’ This section acts as a pivotal point in the process, where you will be prompted to provide the details that require modification. It is essential to fill in these details accurately and comprehensively to ensure that the changes are processed smoothly and accurately.

- As you progress through the application, you will encounter a segment where you are required to upload supporting documents as per the specified guidelines. These documents play a crucial role in validating the changes you are requesting and are essential for the verification process. Ensure that the documents you upload are clear, valid, and in the prescribed format to facilitate a seamless review and approval process.

- Once you have completed the form and uploaded the necessary documents, proceed to click on the ‘Submit’ button to officially submit your change or correction request. This action signifies the final step in the online application process and initiates the review and processing of your requested changes. Following the submission of your application, you can expect your changes to be processed and reflected in your PAN card within a few days.

- It is important to note that the timeline for the changes to reflect in your PAN card may vary depending on the volume of requests being processed. However, rest assured that the authorities diligently work to ensure timely updates and accurate information on all PAN cards. In the event of any discrepancies or delays, you can track the status of your application through the UTI website or reach out to their customer support for assistance and updates on the progress of your request.

- By following these detailed steps and guidelines provided by UTI, you can effectively navigate the process of changing or correcting details on your PAN card with ease and efficiency. Remember to double-check all the information provided before submission and adhere to the specified requirements to facilitate a smooth and successful update of your PAN card details.