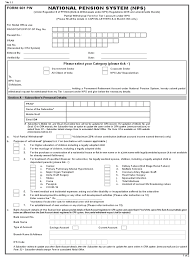

You can download the NPS Withdrawal Form PDF for free by using the direct link provided below on the page.

NPS Withdrawal Form PDF

The National Pension System (NPS) offers various withdrawal options tailored to different circumstances and types of exits from the scheme. These withdrawal limits are designed to ensure a structured and regulated process for individuals looking to access their accumulated pension savings. Understanding the specific withdrawal limits based on the type of exit is crucial for participants to make informed decisions regarding their pension benefits.

For government employees seeking to withdraw their accumulated pension savings before retirement, the NPS Withdrawal Form PDF serves as a vital tool in initiating the withdrawal process. This form streamlines the procedure for government employees, providing a clear and standardized method to access their pension funds when needed. By utilizing Form 302, corporate employees and other citizens can also efficiently withdraw their accumulated pension savings before retirement, ensuring a seamless and transparent process for individuals across various sectors.

It is essential to recognize that the withdrawal process from the National Pension System is governed by specific guidelines and regulations to safeguard the interests of participants and maintain the integrity of the pension scheme. By adhering to these established procedures and utilizing the designated withdrawal forms, individuals can navigate the withdrawal process effectively and access their pension benefits in a structured and regulated manner.

The availability of distinct withdrawal forms tailored to different categories of participants underscores the NPS’s commitment to providing a flexible and inclusive platform for individuals to manage their pension savings. Whether it is government employees, corporate professionals, or other citizens, the NPS accommodates diverse needs and preferences, ensuring that participants can access their pension funds in a manner that aligns with their specific circumstances and requirements.

In addition to the withdrawal forms, participants in the National Pension System can benefit from comprehensive guidance and support regarding the withdrawal process. The NPS offers resources and assistance to help individuals understand the various withdrawal options, eligibility criteria, and documentation requirements, empowering participants to make well-informed decisions about their pension benefits. This educational support enhances transparency and clarity in the withdrawal process, enabling participants to navigate the complexities of pension withdrawals with confidence and ease.

The structured approach to pension withdrawals within the National Pension System reflects a commitment to efficiency, accountability, and participant-centric service delivery. By establishing clear withdrawal limits, standardized forms, and robust support mechanisms, the NPS prioritizes the needs and interests of its participants, ensuring a seamless and user-friendly experience for individuals seeking to access their pension savings. This commitment to excellence and customer satisfaction underscores the NPS’s reputation as a reliable and responsive pension scheme that prioritizes the financial well-being and security of its participants.

NPS Withdrawal Limit for Tier 2 Account

National Pension System regulations, NPS Tier 2 withdrawals are notably unrestricted, unlike NPS Tier 1 withdrawals, which adhere to specific rules and limits. This distinction ensures flexibility for participants accessing funds from their NPS Tier 2 accounts while maintaining a structured framework for NPS Tier 1 withdrawals.

The absence of constraints on Tier 2 withdrawals offers individuals greater freedom in managing their investments, complementing the regulated approach governing Tier 1 withdrawals. This dual-tier system provides participants with a balanced combination of accessibility and regulation, catering to diverse financial needs and preferences within the National Pension System framework.

NPS Withdrawal Limit for Tier 1 Account

- The withdrawal limits within the National Pension System (NPS) are intricately defined based on the withdrawal type and the amount being accessed from the NPS Tier 1 account. Key rules govern different withdrawal scenarios, including premature withdrawal, partial withdrawal, and withdrawal after maturity.

- For premature withdrawals from NPS Tier 1 accounts, individuals can access their investments after three years or upon reaching 60 years of age. This early withdrawal, termed “premature exit,” allows a 20% corpus withdrawal, with the remaining 80% directed towards purchasing an annuity. Both the 20% withdrawal and the annuity are subject to taxation, emphasizing the financial implications of premature exits from the NPS.

- In cases of partial withdrawals, NPS participants can access a portion of their corpus for specific purposes. As per current NPS rules, the maximum withdrawal limit stands at 25% of the total contribution, not based on the overall NPS account balance. This provision offers flexibility for individuals to address immediate financial needs while maintaining a regulated approach to managing their NPS savings.