You can download the New Tax Regime Slab & Exemption List PDF for free by using the direct link provided below on the page.

New Tax Regime Slab & Exemption List PDF

The New Tax Regime was introduced as a significant overhaul of the existing tax structure, aimed at simplifying the tax system and making it more taxpayer-friendly. This new framework features altered tax slabs and concessional tax rates that apply broadly to all taxpayers. This includes not only individual taxpayers but also Hindu Undivided Families (HUFs) and Association of Persons (AOPs), ensuring that a wide spectrum of the population benefits from the changes.

One of the key features of the New Tax Regime is its approach to salary income. Previously, taxpayers could only avail of the Standard Deduction of Rs 50,000 under the Old Tax Regime. However, in a move to make the New Tax Regime more attractive, this Standard Deduction has now been extended to include taxpayers opting for the new framework. This means that individuals can effectively reduce their taxable income by this amount, thereby lowering their overall tax liability.

With the introduction of the New Tax Regime, taxpayers can enjoy a tax-free income of up to Rs 7.5 lakhs. This threshold is particularly significant, as it allows individuals to retain more of their earnings without being burdened by the taxman. The calculation of this tax-free income takes into account the Standard Deduction and the tax rebate available under Section 87A, which further enhances the appeal of the new tax structure. Under this provision, individuals with a total taxable income of up to Rs 5 lakhs are eligible for a rebate of up to Rs 2,500, effectively making their income tax liability zero.

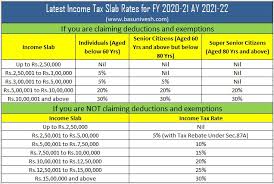

The New Tax Regime also introduces a series of tax slabs that are designed to be simpler and more straightforward compared to the Old Tax Regime. For instance, the tax rates have been reduced across various income brackets, allowing for a more equitable distribution of the tax burden. This reduction in rates can significantly benefit middle-class taxpayers, who often find themselves in the midst of the tax spectrum.

The New Tax Regime eliminates several deductions and exemptions that were previously available under the Old Tax Regime. While this may seem like a drawback at first glance, the intention behind this move is to create a more streamlined and transparent tax process. By removing these complexities, the government aims to encourage compliance and reduce the administrative burden on both taxpayers and tax authorities. This shift is expected to foster a more conducive environment for taxpayers, as they can now focus on their earnings without being overwhelmed by the intricacies of tax planning.

The New Tax Regime is designed to promote ease of compliance. Taxpayers can file their returns more efficiently, as the need to maintain extensive records of deductions and exemptions is minimized. This simplification can lead to a more significant number of taxpayers fulfilling their tax obligations, which ultimately benefits the economy as a whole.

It is also worth noting that the New Tax Regime is optional. Taxpayers have the flexibility to choose between the Old Tax Regime and the New Tax Regime based on their individual financial situations. This choice empowers taxpayers to select the regime that aligns best with their financial goals and circumstances. For some, the Old Tax Regime may still provide more benefits due to specific deductions and exemptions relevant to their income sources. Thus, the introduction of the New Tax Regime does not eliminate the previous options but rather adds a new layer of choice for taxpayers.

The government has also made efforts to educate taxpayers about the nuances of the New Tax Regime. Various informational campaigns have been launched to ensure that individuals understand the implications of the new tax structure. This commitment to taxpayer education is crucial, as it enables individuals to make informed decisions regarding their tax liabilities. By providing clear guidelines and resources, the government aims to foster a culture of transparency and accountability in tax compliance.

The New Tax Regime represents a pivotal shift in the Indian tax landscape, characterized by altered tax slabs and concessional tax rates that aim to benefit a wide array of taxpayers. By extending the Standard Deduction to the new framework and allowing for a tax-free income of Rs 7.5 lakhs, the government has taken significant steps to alleviate the tax burden on individuals. The simplification of tax slabs and the elimination of numerous deductions and exemptions further contribute to a more transparent and efficient tax system. Ultimately, the choice between the Old and New Tax Regimes empowers taxpayers, allowing them to select the framework that best suits their financial needs. Through ongoing education and support, the government seeks to ensure that all taxpayers can navigate this new landscape with confidence, fostering a more compliant and informed citizenry.

New Tax Regime Exemption List 2024

Transport Allowances for Persons with Disabilities (PwD)

- Transport allowances play a crucial role in supporting Persons with Disabilities (PwD) by ensuring they have the necessary means to travel for various purposes. These allowances can include Conveyance Allowance, which is provided to facilitate daily commuting and access to essential services. This allowance is particularly significant for individuals who may face challenges in using public transport due to their disabilities.

- To conveyance, there are provisions for Travel, Tour, and Transfer Compensation. This compensation is designed to cover expenses incurred during official travel, ensuring that PwD employees can perform their duties without financial burden. It is essential for organizations to recognize the unique needs of these individuals during travel or relocation.

- Perquisites for Official Purposes are also applicable to PwD, providing additional support in terms of resources and benefits that can enhance their work experience. These perks may include special accommodations or transportation arrangements that cater specifically to their needs.

- Another significant aspect is the Exemptions for the Voluntary Retirement Scheme under Section 10(10C), which allows PwD individuals to retire from service while receiving a tax exemption on the compensation they receive. This measure acknowledges the challenges faced by individuals with disabilities in the workforce.

- The Gratuity Amount under Section 10(10) ensures that employees with disabilities receive a fair amount upon leaving their job, reflecting their service and contributions. Similarly, **Leave Encashment under Section 10(10AA)** provides financial support for unused leave days, allowing PwD employees to benefit from their accrued leave.

- Interest on Home Loan for Lent-out Property under Section 24 offers tax deductions that can ease the financial strain of housing for PwD individuals. This benefit is particularly important as it encourages homeownership and stability.

- PwD individuals can also receive Gifts of Up to Rs. 5,000, which can serve as a form of financial assistance or support from friends, family, or employers. Furthermore, Employer’s Contributions to Employees’ NPS Accounts under Section 80CCD(2) provide a means for building a secure financial future through retirement savings.

- There are Additional Employee Costs under Section 80JJA that may apply, allowing employers to claim deductions for expenses incurred in providing a supportive work environment for employees with disabilities. Lastly, Deductions on Deposits in the Agniveer Corpus Fund under Section 80CCH(2) offer another avenue for financial planning and security for PwD individuals.

- These various allowances and exemptions are vital in promoting inclusivity and providing necessary support to Persons with Disabilities, ensuring they have equal opportunities and resources in their professional and personal lives.