You can download the Income Tax Computation Format PDF for free by using the direct link provided below on the page.

Income Tax Computation Format PDF

Income tax calculation is a crucial aspect of financial planning for individuals, as it determines the amount of tax they owe to the government based on their earnings. The tax payable is computed according to the applicable tax slab rates, which are structured based on income levels. After accounting for various deductions, taxes already paid like Advance Tax, and Tax Deducted at Source (TDS), the remaining taxable income is subject to taxation at the relevant slab rate.

To calculate your income tax accurately, you must take into account multiple factors that influence the final tax liability. These factors include your total taxable income, prevailing tax rates, deductions allowed under the Income Tax Act, and exemptions that may apply to specific income sources. By considering these elements, you can arrive at the correct amount of tax due to the authorities.

The process of income tax computation involves meticulous assessment of all income sources, including salary, business profits, capital gains, rental income, and other earnings subject to taxation. Deductions such as those for investments in specified instruments like Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS), and National Pension System (NPS) play a crucial role in reducing the taxable income and subsequently the tax liability.

Exemptions granted under various sections of the Income Tax Act, such as House Rent Allowance (HRA), Leave Travel Allowance (LTA), and allowances for specific expenditures, contribute to lowering the overall tax burden on individuals. By leveraging these deductions and exemptions effectively, taxpayers can optimize their tax planning strategies and minimize their tax outflow.

In addition to these deductions and exemptions, taxpayers can benefit from tax-saving schemes like the Senior Citizens Savings Scheme (SCSS), Sukanya Samriddhi Yojana, and tax-saving fixed deposits offered by banks. These investment avenues not only help in saving tax but also aid in wealth creation and financial security in the long run.

It is essential for taxpayers to maintain accurate records of their income, expenses, investments, and tax-related documents to facilitate smooth income tax filing and computation. Utilizing tools like the Income Tax Computation Format for Assessment Year 2023-24, available in PDF format, can assist individuals in organizing their financial data effectively and ensuring compliance with tax regulations.

By understanding the intricacies of income tax calculation, leveraging deductions and exemptions smartly, and staying abreast of the latest tax updates, individuals can navigate the tax system efficiently and optimize their tax liabilities. Effective tax planning is key to financial well-being and ensuring compliance with legal requirements, thereby fostering financial stability and growth.

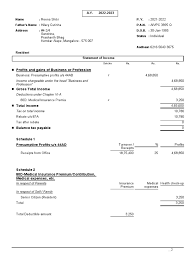

Income Tax Computation Format for AY 2023-24

- When calculating income tax, several key pieces of information are essential. These include your full name, Permanent Account Number (PAN), date of birth, assessment year (A.Y.), details of your basic salary, taxable allowances, and the taxable value of perquisites. These components form the foundation for determining your gross salary, which is the total income before deductions.

- After calculating the gross salary, the next step involves subtracting certain components to arrive at the net taxable salary. This includes deductions like the standard deduction, which is a fixed amount allowed as a deduction from the gross salary. Additionally, the entertainment allowance and professional tax are subtracted from the gross salary to reach the final net taxable salary amount.

- It’s important to accurately record all these details to ensure precise income tax calculation and compliance with tax regulations. By meticulously documenting your income components and deductions, you can streamline the tax filing process and optimize your tax liability.

- Understanding the nuances of each component in the income tax calculation process empowers individuals to make informed financial decisions and effectively plan for their tax obligations. By maintaining organized records and staying informed about tax laws and regulations, individuals can navigate the tax system with confidence and ensure financial stability.