You can download the From 26AS Tax Credit statement PDF for free by using the direct link provided below on the page.

From 26AS Tax Credit statement PDF

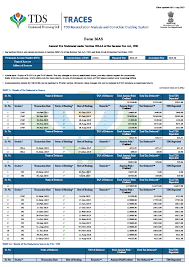

Form 26AS is an important document that provides a consolidated view of your tax-related information. It contains details of the tax deducted by the deductor, such as your employer or bank, on your behalf. This includes tax deducted at source (TDS) and details of advance tax payments. The primary purpose of Form 26AS is to ensure transparency and accuracy in tax-related transactions. It helps you keep track of the taxes that have been paid on your behalf and provides a comprehensive summary of your tax liabilities and refunds, if any.

By referring to Form 26AS, you can easily access information about the taxes that have been deducted from your income, such as salary, interest, or dividends. This allows you to verify whether the correct amount of tax has been deducted and deposited with the government. Additionally, Form 26AS also provides details of any high-value transactions that have been reported to the tax authorities. This helps the government monitor and prevent tax evasion and other financial irregularities.

To access your Form 26AS, you can log in to your account on the Income Tax Department’s official website or through your net banking portal. Once you have logged in, you can view and download your Form 26AS for the relevant assessment year. It is important to regularly review your Form 26AS to ensure that all the tax-related information is accurate and up to date.

Any discrepancies or errors should be promptly brought to the attention of the relevant authorities for rectification. By understanding and keeping track of your Form 26AS, you can effectively manage your tax obligations and ensure compliance with the tax laws. It serves as a valuable tool for maintaining transparency and accountability in the tax system.

From 26AS Tax Credit statement

- Form 26AS, also known as the annual consolidated statement, is a crucial document that contains all the important tax-related information for taxpayers like you and me. To access Form 26AS, all you need is your PAN (Permanent Account Number) and you can easily get it from the income tax website.

- what Form 26AS actually includes. It provides details about the transactions reported in the Annual Information Report. It also shows the tax collected by tax collectors on your behalf, as well as the tax deducted by the deductor on your income. Additionally, it displays the amount of advance tax, self-assessment tax, and regular assessment tax that have been deposited by PAN holders or taxpayers like us.

- Form 26AS also shows the tax deducted on your income by various deductors and provides information about any refunds you may have received during the financial year. And don’t forget, it even includes details about high-value transactions related to shares, mutual funds, and more.

- y reviewing your Form 26AS, you can keep track of all these important tax-related details and ensure that everything is accurate and up to date. It helps you stay on top of your tax obligations and makes the whole process more transparent and hassle-free.