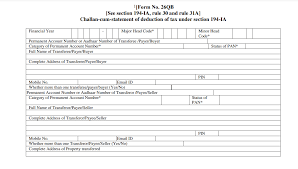

You can download the Form No- 26QB Statement of Deduction of Tax PDF for free by using the direct link provided below on the page.

Form No- 26QB Statement of Deduction of Tax PDF

Downloading Form No – 26QB Statement of Deduction of Tax in PDF format is a critical step in the tax payment process. This form serves as a record of tax deducted at source (TDS) and is essential for individuals and entities involved in property transactions. By obtaining Form 26QB, taxpayers can ensure compliance with TDS regulations and fulfill their tax obligations to the government efficiently.

Form 26QB functions as a return cum challan for the payment of TDS to the government. It acts as a formal document through which TDS deductions made by the buyer are reported and remitted to the tax authorities. This form plays a pivotal role in the tax collection mechanism, ensuring that the appropriate amount of tax is withheld and deposited with the government as per the Income Tax Act.

In addition to Form 26QB, Form 16B holds significance in the TDS process. Form 16B is a TDS certificate issued by the buyer to the seller to acknowledge the TDS amount deducted during property transactions. It serves as a proof of tax deduction and provides essential information to the seller for their tax compliance and filing requirements. When filling out the Form 26QB challan, it is crucial for each buyer to accurately complete the details for every unique buyer-seller combination.

This meticulous approach ensures that TDS deductions are correctly attributed to the respective parties involved in the transaction. By providing accurate information in the challan, taxpayers can avoid discrepancies, penalties, and delays in the processing of TDS payments.

By adhering to the guidelines outlined in Form 26QB and diligently completing the challan for each buyer-seller combination, taxpayers can contribute to a transparent and efficient tax system. Timely submission of TDS payments and proper documentation not only fulfills legal requirements but also promotes tax compliance and accountability in financial transactions.

The proper understanding and adherence to the procedures associated with Form 26QB and TDS payments are essential for maintaining tax discipline and upholding regulatory standards in financial transactions. By following these guidelines and accurately documenting TDS deductions, taxpayers can navigate the tax landscape with confidence and integrity.

Form No- 26QB Statement of Deduction of Tax (Procedure)

- When navigating to the TIN NSDL website, users are directed to access the specific section related to TDS on the sale of property. By clicking on the “Online form for furnishing TDS on property (Form 26QB)” link, individuals can initiate the process of filling out the necessary details for TDS compliance. This online platform streamlines the submission of TDS information and simplifies the procedure for taxpayers.

- Selecting the appropriate challan, such as “TDS on Sale of Property,” is crucial in ensuring that the TDS payment is correctly categorized and attributed to the relevant transaction. This selection aligns the payment with the specific nature of the property sale and facilitates accurate reporting to the tax authorities.

- When completing the form, users must have essential information readily available to populate the fields accurately. Details such as the PAN of the seller and buyer, communication information of both parties, specific property details, and the relevant payment and tax deposit information are integral to the proper documentation of TDS deductions. By providing this information meticulously, taxpayers contribute to the transparency and integrity of the tax system.

- Upon submitting the duly filled form, a confirmation screen confirms the successful submission and displays a unique acknowledgment number. This number serves as a reference for future inquiries or communications related to the TDS payment. Saving this acknowledgment number is advisable to facilitate any follow-up actions or queries that may arise in the future.

- By clicking on “Print Form 26QB,” users can generate a printable version of the form for their records. Subsequently, selecting “Submit to the bank” initiates the online payment process through internet banking. This seamless transition to the payment page streamlines the transaction and ensures the timely remittance of the TDS amount.

- Following a successful payment, a challan counterfoil is generated, providing a tangible proof of the payment made. This document contains essential details such as the Challan Identification Number (CIN), payment specifics, and the name of the bank through which the e-payment was processed. Retaining this counterfoil serves as evidence of compliance with TDS regulations and facilitates accurate record-keeping for future reference.

- By adhering to these steps and understanding the intricacies of the Form 26QB submission and payment process, taxpayers can navigate the TDS requirements for property transactions with confidence and efficiency. Proper documentation and adherence to guidelines contribute to a seamless tax compliance experience and reinforce the integrity of financial transactions in the real estate sector.