You can download the EPF Return Form 3A PDF for free by using the direct link provided below on the page.

EPF Return Form 3A PDF

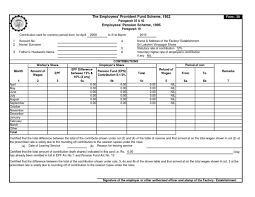

EPF Return Form 3A is an important document that employers need to provide to their employees. It helps track the monthly recoveries made towards the Employee Provident Fund (EPF) and Pension Fund for each employee throughout the financial year. The Member’s Annual Contribution Card, which is a part of Form 3A, serves as a record of the EPF and Pension Fund contributions made by the employer on behalf of the employee. This card shows the month-wise recoveries, ensuring transparency and accountability.

It’s crucial for employers to furnish this form before 30th April of the following year. By doing so, they ensure that employees have access to accurate and up-to-date information about their EPF and Pension Fund contributions. EPF contributions are an important aspect of an employee’s financial planning. These contributions are deducted from the employee’s salary and are deposited into their EPF account. The EPF scheme is designed to provide financial security and stability to employees after their retirement.

It’s important to note that EPF contributions can only be withdrawn by the employee at the time of their retirement, with a few exceptions. This ensures that the EPF funds are used for their intended purpose of providing a financial cushion during the employee’s retirement years. The EPF Return Form 3A plays a crucial role in keeping track of these contributions and ensuring that both employers and employees have a clear understanding of the funds being allocated towards the EPF and Pension Fund.

So, it’s essential for employers to diligently fill out and submit the EPF Return Form 3A before the deadline. This helps maintain accurate records and ensures that employees have access to the necessary information regarding their EPF and Pension Fund contributions.

PF Form 3A download – EPF Return (Required Details)

1. Account No.: This is the unique identification number assigned to each employee’s EPF account.

2. Name/Surname: Enter the employee’s full name and surname in this field.

3. Father’s/Husband’s Name: Provide the name of the employee’s father or husband, depending on their marital status.

4. Name & Address of the Factory Establishment: Fill in the details of the factory or establishment where the employee is working, including the full name and address.

5. Statutory rate of Contribution: This field indicates the standard rate of EPF contribution, which is usually 12% of the employee’s wages.

6. Voluntary higher rate of employee’s Contribution if any: If the employee chooses to contribute a higher percentage of their wages voluntarily, it can be mentioned in this field.

7. Signature of employer with office seal: The employer should sign the form and affix the official seal to validate the information provided.

8. Month: Specify the month for which the EPF Return Form is being filled out.

9. Worker’s Share: Enter the amount of EPF contribution deducted from the worker’s wages for the specified month.

10. Amount of wages and EPF: This field includes the total wages earned by the worker for the month, along with the corresponding EPF contribution.

11. Employer’s Share: Indicate the amount contributed by the employer towards the employee’s EPF account.

12. EPF difference between 12% & 8.33% (if any): If there is a difference between the standard EPF contribution rate of 12% and the pension fund contribution rate of 8.33%, it should be mentioned here.

13. PENSION FUND Contribution 8.33%: Enter the amount contributed towards the employee’s pension fund, which is typically 8.33% of the wages.

14. Refund of Adv.: If any advance amount has been refunded to the employee, it can be recorded in this field.

15. No. of days/period of non-contributing service (if any): If there are any days or periods during which the employee did not contribute to the EPF, it should be mentioned here.

16. Remarks: Any additional comments or remarks related to the EPF contributions can be included.