You can download the Audit Trail Applicability Notification PDF for free by using the direct link provided below on the page.

Audit Trail Applicability Notification PDF

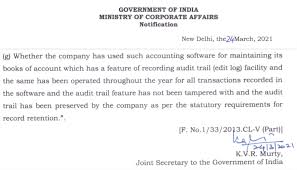

The Ministry of Company Affairs (MCA) has taken a significant step towards enhancing transparency and accountability in corporate operations by introducing a crucial requirement for companies regarding the implementation of an audit trail feature in their accounting software. This regulatory initiative, as outlined in the MCA’s notifications dated March 24, 2021, and April 1, 2022, underscores the importance of maintaining accurate and traceable financial records within the corporate sector.

Effective from April 1, 2023, every company operating under the purview of the MCA is mandated to incorporate the audit trail feature into their accounting software. This feature serves as a vital tool in tracking and documenting all financial transactions and modifications made within the software, ensuring a comprehensive and verifiable record of financial activities undertaken by the company.

The recent notification issued by the Ministry of Corporate Affairs (MCA) signifies a pivotal amendment to the implementation timeline of the audit trail rule in accounting software for companies. By setting the revised deadline of April 1, 2023, for the enforcement of this rule, the MCA aims to provide companies with adequate time to prepare and integrate the necessary software modifications to comply with the regulatory requirements effectively.

The introduction of the audit trail feature in accounting software aligns with global best practices in financial governance and serves as a proactive measure to prevent fraud, errors, and unauthorized alterations in financial data. By incorporating this feature, companies can enhance the integrity and reliability of their financial reporting processes, fostering trust among stakeholders and regulatory bodies.

The implementation of the audit trail rule underscores the MCA’s commitment to promoting transparency, accuracy, and compliance within the corporate sector. Companies are encouraged to proactively engage with this regulatory mandate, ensuring that their accounting software systems are equipped with the necessary functionalities to generate and maintain a comprehensive audit trail of financial activities.

The requirement for companies to integrate the audit trail feature in their accounting software represents a significant milestone in bolstering financial governance and accountability standards across the corporate landscape. By embracing this regulatory directive, companies can fortify their financial controls, mitigate risks, and uphold the principles of transparency and integrity in their financial operations.

Audit Trail Applicability Notification

An audit trail serves as a crucial component within a computer system or application, capturing a detailed record of all events and activities that transpire within the system. This chronological sequence of events offers a comprehensive overview of transactions, operations, and events, enabling users to trace the history of specific actions undertaken within the system. Key information included in an audit trail ranges from user access details to data modifications, timestamps of activities, failed login attempts, system errors, and various other system interactions. The primary purpose of an audit trail lies in bolstering security measures and ensuring compliance with regulatory standards.

By maintaining a robust audit trail, organizations can effectively monitor system activities, detect unauthorized access or modifications, and investigate potential security breaches or data tampering incidents. This proactive approach to security not only safeguards sensitive information but also aids in regulatory compliance efforts, particularly in industries where data integrity and confidentiality are paramount, such as healthcare and finance.

In light of evolving regulatory frameworks, Rule 11(g) emerges as a pivotal mandate that places emphasis on auditors reporting on the utilization of accounting software equipped with audit trail functionalities. This rule signifies a significant shift towards enhancing the accuracy, reliability, and transparency of companies’ financial records and reporting processes. By mandating the use of accounting software with audit trail capabilities, Rule 11(g) aims to instill greater accountability and integrity in financial practices, ensuring that companies adhere to stringent standards of financial governance.

The implementation of Rule 11(g) underscores the regulatory authorities’ commitment to promoting best practices in financial reporting and governance. By requiring auditors to assess the adequacy and effectiveness of audit trail features within accounting software, this rule seeks to enhance the overall quality and credibility of financial reporting, thereby fostering trust among stakeholders and regulatory bodies. Moreover, the enforcement of Rule 11(g) serves as a proactive measure to deter fraudulent activities, errors, and discrepancies in financial data, ultimately contributing to a more robust and transparent financial ecosystem.

The integration of audit trail mechanisms and the enforcement of Rule 11(g) represent pivotal steps towards fortifying financial controls, enhancing transparency, and upholding the principles of accountability within the corporate landscape. By adhering to these regulatory mandates and leveraging advanced accounting software with audit trail capabilities, companies can proactively safeguard their financial integrity, mitigate risks, and uphold the highest standards of financial governance and compliance.