You can download the AIBEA Defaulters List 2024 PDF for free by using the direct link provided below on the page.

AIBEA Defaulters List 2024 PDF

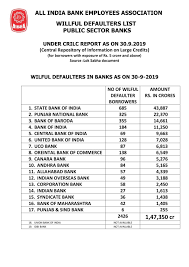

The All India Bank Employees Association (AIBEA) recently made headlines by releasing a comprehensive list of wilful defaulters in India. This list, which includes a staggering 2,426 borrower accounts, sheds light on the alarming issue of unpaid loans that have been categorized as “wilful defaults.” These defaulters collectively owe a whopping ₹1,47,350 crore to the banking system. It is important to note that the list released by AIBEA specifically focuses on public sector banks. The association compiled this information based on the Central Repository of Information on Large Credits (CRILC) report, which provides a snapshot of the financial landscape as of September 30th of the previous year.

The term “wilful defaulter” refers to individuals or entities who deliberately and intentionally fail to repay their loans, despite having the financial means to do so. This categorization is not applied lightly, as it requires a thorough examination of the borrower’s financial situation and their ability to fulfill their repayment obligations. The release of this list serves as a wake-up call for the banking sector and highlights the need for stricter regulations and measures to prevent such defaults. The staggering amount of ₹1,47,350 crore owed to the banking system is a significant burden that affects not only the banks but also the economy as a whole.

One of the key factors behind wilful defaults is the lack of accountability and consequences for defaulters. Many borrowers take advantage of loopholes and legal complexities to evade repayment, causing significant financial strain on the banking system. This list aims to expose these defaulters and bring them to justice. The AIBEA’s initiative to release this list is a step towards transparency and accountability. By making this information public, they hope to put pressure on the defaulters to fulfill their repayment obligations and discourage others from resorting to similar practices.

It is worth mentioning that the list of wilful defaulters is not exhaustive, as it only includes accounts from public sector banks. There may be additional defaulters in private sector banks or other financial institutions. However, the release of this list serves as a starting point for identifying and addressing the issue of wilful defaults in India. To tackle the problem of wilful defaults, it is essential for banks and regulatory authorities to work hand in hand. Stricter lending practices, improved risk assessment mechanisms, and enhanced monitoring of borrowers’ financial activities are some of the measures that can be implemented to prevent defaults from occurring in the first place.

Legal reforms are necessary to expedite the recovery process and ensure that defaulters face appropriate consequences for their actions. This includes streamlining the legal system, strengthening the recovery mechanisms, and establishing specialized courts to handle cases related to wilful defaults. In conclusion, the release of the list of wilful defaulters by the All India Bank Employees Association sheds light on a pressing issue in India’s banking sector. The staggering amount of ₹1,47,350 crore owed to public sector banks highlights the urgent need for stricter regulations, improved accountability, and effective recovery mechanisms. By addressing this issue head-on, India can pave the way for a more resilient and transparent financial system that benefits both banks and the economy as a whole.

AIBEA Defaulters List 2024

1. Gitanjali Gems: With dues of ₹ 4,644 crore, Gitanjali Gems is one of the major accounts on the list.

2. ABG Shipyard: Coming in at ₹ 1,875 crore, ABG Shipyard is another account with significant exposure.

3. Rei Agro: Rei Agro has dues amounting to ₹ 2,423 crore, making it one of the accounts with higher outstanding amounts.

4. Ruchi Soya Industries: This company has dues totaling ₹ 1,618 crore, which is a substantial amount.

5. Gilli India: With dues of ₹ 1,447 crore, Gilli India is another account that has a significant outstanding balance.

6. Winsome Diamonds and Jewellery: This account has a hefty sum of ₹ 2,918 crore in dues.

7. Kudos Chemie: Kudos Chemie holds a significant exposure of ₹ 1,810 crore.

8. Nakshatra Brands: With dues amounting to ₹ 1,109 crore, Nakshatra Brands is another notable account on the list.

9. Kingfisher Airlines: Despite being a well-known name, Kingfisher Airlines has dues of ₹ 586 crore.