You can download the Present Value Interest Factor Table (PVIFA) PDF for free by using the direct link provided below on the page.

Present Value Interest Factor Table (PVIFA) PDF

The factor used to calculate the present value of a series of annuity payments is known as the Present Value Interest Factor of Annuity, commonly abbreviated as PVIFA. This financial concept plays a crucial role in the field of finance and investment, as it allows individuals and organizations to assess the current worth of future cash flows. Understanding PVIFA is essential for making informed financial decisions, especially when it comes to investments that involve regular payments over time.

The PVIFA is essentially a numerical representation that facilitates the conversion of future cash flows from an annuity into their present value. By using this factor, financial analysts and investors can determine how much a series of future payments is worth in today’s terms. This is particularly important for individuals looking to evaluate the attractiveness of various investment opportunities, as it enables them to compare cash flows that occur at different times.

One of the key aspects of PVIFA is its ability to account for the time value of money. The time value of money is a fundamental principle in finance that asserts that a dollar today is worth more than a dollar in the future due to its potential earning capacity. This means that if you invest a certain amount of money today, it has the potential to grow over time through interest or investment returns. Therefore, when calculating the present value of future annuity payments, it is essential to consider this principle to arrive at an accurate assessment.

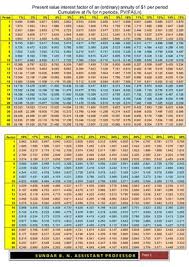

To calculate the present value of an annuity using PVIFA, you need to know two critical elements: the periodic interest rate (r) and the number of payment periods (n). The periodic interest rate is the rate at which the investment is expected to grow, while the number of payment periods refers to the total number of times payments will be made. By knowing these two factors, you can easily find the PVIFA value using financial tables or formulas.

Once you have the PVIFA factor value, the next step is to multiply it by the periodic payment amount. This multiplication gives you the current present value of the annuity. For example, if you expect to receive a series of payments of $1,000 per year for five years, and the PVIFA for a 5% interest rate and 5 payment periods is 4.3295, you would calculate the present value of the annuity as follows: $1,000 * 4.3295 = $4,329.50. This means that the total worth of those future payments, when discounted back to the present value, is $4,329.50.

The use of PVIFA is particularly beneficial in various financial scenarios, such as retirement planning, loan amortization, and investment analysis. For instance, individuals planning for retirement often use PVIFA to determine how much they need to save today to achieve their desired retirement income. By estimating future expenses and using PVIFA, they can calculate the present value of those expenses and set realistic savings goals.

In loan amortization, lenders and borrowers can utilize PVIFA to understand the present value of future loan payments. This helps both parties assess the overall cost of the loan and determine whether the terms are favorable. By calculating the present value of the loan payments, borrowers can make informed decisions about whether to accept the loan offer or seek alternative financing options.

PVIFA is commonly used in investment analysis to evaluate the profitability of various projects and investments. Investors can use this factor to assess the present value of expected cash inflows from an investment, enabling them to make comparisons with other investment opportunities. By understanding the present value of future cash flows, investors can prioritize projects that offer the best returns relative to their risks.

PVIFA is not just limited to financial professionals; it can also be a valuable tool for individuals managing their personal finances. Understanding how to calculate the present value of annuities can empower individuals to make better financial decisions, whether they are evaluating savings plans, insurance policies, or other financial products. By grasping the concept of PVIFA, individuals can take charge of their financial futures and work towards achieving their financial goals.

It is also important to note that the calculation of PVIFA can be done using financial calculators or spreadsheet software, which simplifies the process significantly. Many online resources provide PVIFA tables, allowing users to quickly find the factor values for different interest rates and time periods. This accessibility makes it easier for anyone to utilize PVIFA in their financial planning and decision-making processes.

The Present Value Interest Factor of Annuity (PVIFA) is a vital tool in finance that allows individuals and organizations to calculate the present value of a series of future annuity payments. By understanding and applying PVIFA, one can effectively assess the worth of future cash flows, taking into account the time value of money. Whether for retirement planning, loan amortization, or investment analysis, PVIFA serves as an essential factor in making informed financial decisions. By mastering this concept, individuals can enhance their financial literacy and work towards achieving their long-term financial objectives.