You can download the Telanagana Rythu Bandhu/Bima Claim Form for Life Insurance Scheme PDF for free by using the direct link provided below on the page.

Telanagana Rythu Bandhu/Bima Claim Form for Life Insurance Scheme PDF

The Farmers Group Life Insurance Scheme (Rythu Bima) plays a vital role in providing financial relief and social security to the family members and dependents of farmers in the unfortunate event of the farmer’s demise due to any cause. The scheme aims to alleviate the financial burden faced by the families left behind and ensure that they have the necessary support to meet their day-to-day needs during challenging times.

The loss of a farmer’s life can have a significant impact on the financial stability of their family, leading to severe hardships in meeting basic expenses and fulfilling essential requirements. By enrolling in the Farmer’s Group Life Insurance Scheme, farmers can secure the future of their loved ones and provide them with a sense of financial security in the face of unforeseen circumstances.

One of the key benefits of the scheme is the assurance of financial security and relief to the bereaved members of the farmer’s family. This support extends beyond just monetary assistance and aims to provide a safety net for the family’s well-being and stability in the absence of the primary breadwinner.

To be eligible for enrollment in the Farmers Group Life Insurance Scheme, farmers must fall within the age group of 18 to 59 years. This age range is crucial as it targets the active working population of farmers who are actively engaged in agricultural activities and form the backbone of the rural economy.

By enrolling in the scheme, farmers not only safeguard the financial future of their families but also contribute to building a more resilient and secure agricultural community. The scheme fosters a sense of community support and solidarity among farmers, emphasizing the importance of collective well-being and mutual assistance in times of need.

The Farmers Group Life Insurance Scheme serves as a testament to the government’s commitment to the welfare and protection of farmers, recognizing their invaluable contribution to the agricultural sector and the nation’s economy. It reflects a proactive approach to addressing the financial vulnerabilities faced by farming communities and underscores the significance of social security measures in ensuring a sustainable and inclusive agricultural ecosystem.

The Farmers Group Life Insurance Scheme (Rythu Bima) stands as a beacon of hope and support for farmers and their families, offering a lifeline of financial security and stability in the face of adversity. By enrolling in the scheme, farmers not only secure their loved ones’ future but also contribute to building a more resilient and cohesive agricultural community. The scheme’s impact extends far beyond monetary benefits, fostering a culture of solidarity and support among farmers and underscoring the importance of social security in safeguarding livelihoods and promoting sustainable agriculture.

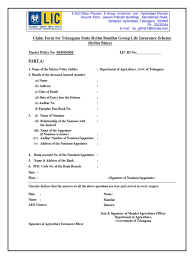

Required Details for Telanagana Rythu Bandhu/Bima Claim Form for Life Insurance

1. Name of the Master Policy Holder: This refers to the individual or entity who holds the primary insurance policy under which the claim is being made. The Master Policy Holder’s name serves as the primary contact point for communication and verification purposes.

2. Details of the deceased insured member: It is essential to gather comprehensive information about the deceased insured member, including their full name, address, date of death, and Aadhar number. This information helps in accurately identifying the insured individual and validating the claim.

3. Name of Nominee: The nominee is the individual designated to receive the insurance proceeds in the event of the insured member’s demise. Mentioning the nominee’s name ensures that the rightful beneficiary is identified and the claim amount is disbursed accordingly.

4. Relationship of the Nominee with the Insured: Specifying the relationship between the nominee and the insured member is crucial for establishing the nominee’s eligibility to receive the insurance benefits. This information helps in verifying the authenticity of the claim and ensuring compliance with the policy terms.

5. Aadhar Number of Nominee/Appointee: The Aadhar number of the nominee or appointee is a unique identification number that aids in verifying their identity and facilitating the transfer of insurance benefits. Providing this information streamlines the claim verification process and ensures accuracy in beneficiary identification.

6. Address of the Nominee/Appointee: The address details of the nominee or appointee are essential for communication and correspondence related to the insurance claim. Including the nominee’s address helps in reaching out for any additional documentation or clarifications during the claim settlement process.

7. Bank account details of the Nominee/Appointee: To facilitate the smooth transfer of the insurance proceeds, it is vital to provide the bank account details of the nominee or appointee. This information ensures that the claim amount is directly deposited into the designated account, expediting the disbursement process.

8. Signature of Nominee/Appointee: Obtaining the signature of the nominee or appointee serves as a confirmation of their acceptance of the insurance benefits and their agreement to the claim settlement terms. The signature acts as a formal acknowledgment of the claim process and helps in maintaining a record of the beneficiary’s consent.