You can download the EPF Return Form 6A PDF for free by using the direct link provided below on the page.

EPF Return Form 6A PDF

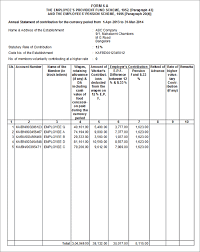

EPF Form 6A is an important document used by employers in India to provide detailed information about their employees’ contributions to the Employees’ Provident Fund (EPF). The EPF is a social security scheme that aims to ensure financial security and retirement benefits for eligible employees. EPF Form 6A is an important document used by employers in India to provide detailed information about their employees’ contributions to the Employees’ Provident Fund (EPF). The EPF is a social security scheme that aims to ensure financial security and retirement benefits for eligible employees.

The Consolidated Annual Contribution Statement provides a comprehensive overview of the contributions made by employees to their EPF accounts over the course of a year. It includes details such as the employee’s name, employee code, contribution amount, and the period for which the contribution was made. This statement is essential for both employers and employees as it helps in accurate record-keeping and ensures transparency in the EPF system.

Submitting EPF Form 6A by the specified deadline is crucial to avoid any penalties or non-compliance issues. Employers should ensure that all the information provided in the form is accurate and up-to-date. Any discrepancies or errors in the form can lead to delays in the processing of EPF contributions and may cause inconvenience to employees.

To fill out EPF Form 6A, employers need to gather the necessary information from their employees, including their EPF account numbers, contribution amounts, and the period for which the contributions were made. It is important to double-check all the details before submitting the form to ensure its accuracy. Employers can obtain EPF Form 6A from the Employees’ Provident Fund Organization (EPFO) website or their nearest EPFO office. The form is available in both physical and electronic formats, allowing employers to choose the method that is most convenient for them.

Once the form is filled out completely and accurately, employers should submit it to the EPFO office within the specified deadline. It is advisable to keep a copy of the form for future reference and record-keeping purposes. By using EPF Form 6A and submitting the Consolidated Annual Contribution Statement, employers contribute to the efficient management of the EPF system. This form ensures transparency, accuracy, and accountability in the process of recording and reporting EPF contributions.

EPF Return Form 6A (Required Details)

1. Name & Address of the Establishment: This section requires the employer to provide the official name and address of the establishment. It helps in identifying the specific organization for which the EPF contributions are being reported.

2. Statutory rate of contribution: Here, the employer needs to mention the prescribed rate of contribution as per the EPF regulations. This rate determines the percentage of wages that both the employer and the employee are required to contribute towards the EPF.

3. Code No. of the Establishment: Every establishment registered under the EPF scheme is assigned a unique code number. This section of the form is where the employer enters their establishment’s code number for identification purposes.

4. No. of members voluntarily contributing at a higher rate: In this section, the employer provides information about the employees who have chosen to contribute at a higher rate than the statutory rate. This could be due to personal preferences or specific agreements between the employer and the employee.

5. Signature of Employer: The employer is required to sign the form to certify the accuracy and authenticity of the information provided. This signature indicates the employer’s responsibility and commitment to fulfilling their obligations under the EPF scheme.

6. Sl. No.: This section is used to assign a serial number to each entry in the form. It helps in organizing and referencing the information provided in a systematic manner.

7. Account No.: Here, the employer enters the EPF account number of each employee. This unique account number is crucial for tracking individual contributions and maintaining accurate records.

8. Wages, retaining allowance (if any) & DA including cash value of food concession paid during the currency period: This section captures the details of the wages and allowances paid to the employees during the specified period. It includes components such as basic wages, retaining allowance, dearness allowance (DA), and the cash value of any food concessions provided.

9. Amount of worker’s contributions deducted from the wages EPF: In this section, the employer records the total amount of EPF contributions deducted from the wages of each employee during the currency period. This helps in calculating the total contributions made by the employees.

10. Refund of Advance: If any employee has received an advance from their EPF account, this section is used to record the details of the refund.