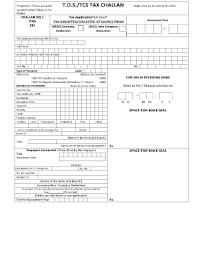

You can download the TDS/TCS Tax Challan Form 281 PDF for free by using the direct link provided below on the page.

TDS/TCS Tax Challan Form 281 PDF

To elaborate on the process of TDS and TCS tax payments, it is essential to understand the significance and procedures involved in these tax deductions. Tax Deducted at Source (TDS) is a fundamental mechanism implemented by the Government to ensure the collection of taxes on various types of payments. When a person, known as the deductor, is about to make a payment of a specified nature (such as salary, rent, etc.) to another party, referred to as the deductee, they are required to deduct a certain percentage of tax from the payable amount. This deducted tax is then deposited with the Income Tax Department.

On the other hand, Tax Collected at Source (TCS) is a tax collected by the seller from the buyer at the time of selling specific goods. This tax collection mechanism ensures that taxes are collected at the point of sale itself, thereby streamlining the tax collection process and enhancing compliance. The TDS/TCS Tax Challan Form 281 serves as the official document for depositing both TDS and TCS amounts, and it is utilized by both corporate and non-corporate entities for tax payment purposes.

The process of filling out Form 281 involves entering detailed information about the deductor, deductee, the nature of payment, the amount from which tax is deducted or collected, and other relevant details. This form serves as a crucial document in the tax payment process, providing a record of the tax deductions made and ensuring compliance with tax regulations set forth by the Income Tax Department.

By downloading Form 281 in PDF format and accurately completing the required fields, entities can fulfill their tax obligations efficiently and in accordance with the stipulated guidelines. Ensuring timely and accurate submission of TDS and TCS payments not only helps in meeting tax compliance requirements but also contributes to the smooth functioning of the overall tax collection system, promoting transparency and accountability in financial transactions.

The process of TDS and TCS tax payments plays a vital role in the taxation system, ensuring that taxes are collected at the source and deposited with the relevant authorities. By understanding the nuances of these tax deduction mechanisms and adhering to the prescribed procedures for tax payment, entities can navigate the tax landscape effectively and contribute to the broader goal of fiscal responsibility and compliance.

TDS/TCS Tax Challan Form 281 Download

- Expanding on the types of challans introduced by the Income Tax Department provides a more comprehensive understanding of the various forms used for tax payments and deposits. These challans serve as essential tools in facilitating the efficient and accurate submission of taxes to the authorities, ensuring compliance with tax regulations and contributing to the smooth functioning of the tax system.

- Challan No. ITNS 280 is a versatile form utilized for a range of tax payments, including Self-Assessment Tax, Advance tax, tax on regular assessment, tax on distributed profits, or income. This form offers taxpayers the flexibility to make payments through online channels or traditional methods such as cheque, DD, etc., at designated bank branches. Regardless of the chosen payment mode, Challan ITNS 280 remains the designated form for processing these various tax payments, providing a standardized approach to tax compliance and payment procedures.

- In contrast, Challan No. ITNS 281 serves a specific purpose in facilitating the deposit of Tax Deducted at Source (TDS) or Tax Collected at Source (TCS). This form is essential for entities required to deduct or collect tax at the source and subsequently remit these amounts to the Income Tax Department. By using Challan ITNS 281, deductors and collectors can accurately report and deposit the deducted or collected tax amounts, ensuring adherence to tax regulations and contributing to the overall tax revenue collection process.

- Lastly, Challan No. ITNS 282 caters to a distinct set of tax payments, including Gift Tax, Wealth Tax, Expenditure Tax, Estate Duty, Securities Transaction Tax, and Other Direct Taxes. This form is designated for individuals or entities liable to make payments related to these specific tax categories, providing a structured format for reporting and remitting the respective tax liabilities. By utilizing Challan ITNS 282 for these tax payments, taxpayers can streamline the payment process and maintain detailed records of their tax obligations across various tax categories.

- The three types of challans introduced by the Income Tax Department offer a systematic approach to tax payments and deposits, catering to a diverse range of tax liabilities and ensuring compliance with tax laws. By understanding the distinct purposes of each challan and following the prescribed procedures for tax payments, taxpayers can navigate the tax payment process effectively and contribute to a transparent and accountable tax ecosystem.