You can download the TDS Rate Chart FY 2023-24 PDF for free by using the direct link provided below on the page.

TDS Rate Chart FY 2023-24 PDF

Tax Deducted at Source (TDS) is a crucial aspect of the Indian tax system, where income tax is deducted from specified payments at the time of making these payments. These payments can include a wide range of transactions such as rent, commission, professional fees, salary, interest, and more. It is mandatory for individuals or entities making these specified payments to deduct TDS as per the provisions of the Income Tax Act.

The process of TDS serves as a mechanism for the Government of India (GOI) to collect income tax directly at the source of income. By deducting tax at the source, the government ensures a steady inflow of tax revenue and promotes tax compliance among taxpayers. TDS operates on the principle of “pay as you earn” and “collect as it is being earned,” facilitating the efficient collection of taxes throughout the financial year.

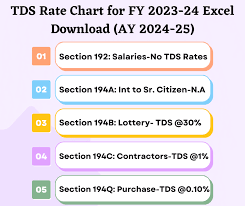

Understanding the TDS rates applicable for each financial year is essential for both taxpayers and entities making specified payments. The TDS Rate Chart for the Financial Year 2023-24 (Assessment Year 2024-25) provides detailed information on the rates at which TDS should be deducted for various types of payments. This chart serves as a guide for taxpayers to comply with TDS regulations and fulfill their tax obligations accurately.

The TDS Rate Chart for FY 2023-24 in PDF format, effective from 1st April 2023, outlines the specific rates applicable to different categories of income and payments. By referring to this comprehensive chart, taxpayers can ensure they are deducting the correct amount of TDS based on the nature of the transaction and the provisions of the Income Tax Act.

It is important to note that accurate compliance with TDS regulations is crucial to avoid penalties and legal implications. Entities making specified payments must diligently follow the TDS provisions to fulfill their tax obligations and contribute to the smooth functioning of the tax system. By deducting TDS at the prescribed rates and timelines, taxpayers demonstrate their commitment to upholding tax laws and supporting the national revenue collection efforts.