You can download the 53rd GST Council Meeting Press Release PDF for free by using the direct link provided below on the page.

53rd GST Council Meeting Press Release PDF

The 53rd GST Council convened under the leadership of Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman, in New Delhi. The meeting witnessed the presence of Union Minister of State for Finance, Shri Pankaj Chaudhary, as well as the Chief Ministers of Goa and Meghalaya. Additionally, the Deputy Chief Ministers of Bihar, Haryana, Madhya Pradesh, and Odisha were in attendance, along with Finance Ministers from various States & UTs (with legislature) and senior officials from the Ministry of Finance & States/UTs.

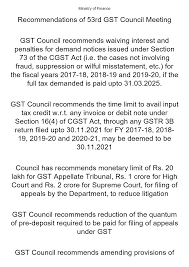

During the GST Council meeting, several crucial recommendations were put forth, encompassing modifications in GST tax rates, initiatives to enhance trade facilitation, and strategies to streamline GST compliance procedures. The council deliberated on various aspects to bolster the efficiency and effectiveness of the Goods and Services Tax (GST) framework, aiming to promote ease of doing business and ensure a more simplified tax regime for businesses and taxpayers across the nation.

One of the key highlights of the meeting was the discussion on revising GST tax rates to align with the evolving economic landscape and cater to the needs of different sectors. The council explored potential adjustments in tax rates to stimulate growth in specific industries, enhance competitiveness, and foster economic development. These proposed changes in tax rates are envisioned to create a more conducive environment for businesses, encourage investments, and propel overall economic growth.

The GST Council emphasized the implementation of measures to facilitate trade by reducing bureaucratic hurdles and enhancing operational efficiencies in the GST system. The council’s recommendations aimed to streamline processes, minimize red tape, and promote a more business-friendly environment that fosters seamless trade operations and boosts economic activity.

In addition to addressing tax rate revisions and trade facilitation measures, the GST Council also focused on simplifying compliance procedures under the GST regime. The council proposed initiatives to enhance compliance mechanisms, reduce administrative burdens on taxpayers, and promote voluntary compliance with GST regulations. These efforts are intended to enhance transparency, improve compliance levels, and ensure a more robust and effective tax administration system under GST.

The collective decisions and recommendations made by the GST Council underscore the commitment to fostering a conducive business environment, promoting economic growth, and ensuring a more efficient and taxpayer-friendly GST framework. The collaborative efforts of the council members reflect a shared vision to drive economic progress, enhance trade facilitation, and streamline compliance procedures for the benefit of businesses and taxpayers nationwide.

53rd GST Council Meeting – GST Revise Rate List

- During the 53rd GST Council meeting, several significant decisions were made to streamline tax rates and exemptions across various sectors. One of the key highlights was the implementation of a uniform 5% IGST rate on imports of ‘Parts, components, testing equipment, tools, and tool-kits of aircraft, regardless of their HS classification. This move aims to boost Maintenance, Repair, and Overhaul (MRO) activities, subject to specific conditions to encourage growth in the aviation sector.

- Additionally, a notable change in GST rates was the adjustment for all milk cans made of steel, iron, and aluminium, which will now attract a 12% GST rate, irrespective of their use. This modification seeks to standardize taxation on milk cans and ensure uniformity in the tax structure.

- The GST rate on ‘carton, boxes, and cases made of both corrugated and non-corrugated paper or paper-board’ (HS 4819 10; 4819 20) has been reduced from 18% to 12%. This reduction aims to promote the packaging industry and facilitate cost-effective packaging solutions for businesses across sectors.

- All solar cookers, whether utilizing a single or dual energy source, will now attract a 12% GST rate. This adjustment aims to encourage the adoption of sustainable and eco-friendly cooking solutions, supporting the renewable energy sector.

- The council also addressed the need to amend the existing entry concerning Poultry keeping Machinery, which previously attracted a 12% GST rate. The amendment specifically incorporates “parts of Poultry keeping Machinery” to address interpretational issues and ensure clarity in taxation.

- The clarification was provided that all types of sprinklers, including fire water sprinklers, will attract a 12% GST rate. This clarification aims to standardize the taxation of sprinkler systems and address any past interpretational challenges for better compliance.

- Additionally, the council extended the IGST exemption on imports of specified items for defence forces for a further period of five years until 30th June 2029. This extension aims to support the defense sector and ensure the smooth procurement of necessary equipment for national security.

- The IGST exemption on imports of research equipment/buoys under the Research Moored Array for African-Asian-Australian Monsoon Analysis and Prediction (RAMA) program was extended, subject to specified conditions. This extension supports research initiatives and scientific endeavors in the region.

- To promote ease of operations in Special Economic Zones (SEZs), Compensation Cess on imports in SEZ by SEZ Unit/developers for authorized operations has been exempted from 1st July 2017. This exemption aims to facilitate business activities within SEZs and promote exports.

- Compensation Cess on the supply of aerated beverages and energy drinks to authorized customers by Unit Run Canteens under the Ministry of Defence has been exempted. This exemption supports the welfare of armed forces personnel and ensures access to quality products at subsidized rates.

- The decisions taken during the GST Council meeting aim to simplify tax structures, promote specific industries, and ensure compliance with GST regulations. These amendments and clarifications reflect the council’s commitment to fostering a conducive business environment and supporting key sectors for economic growth and development.